A POSSIBLE pensions overhaul that could cause a costly hit to thousands of public sector workers has been criticised by a Devon MP.

Rachel Gilmour, the Liberal Democrat MP for Tiverton and Minehead, has questioned the rationale behind a proposal that could see the organisation that oversees the pension investments of public sector workers in Devon, including the county council, disbanded.

The Brunel Pension Partnership encompasses the assets of 10 local government pension schemes – including the Devon Pension Fund – and manages the collective £35 billion from those schemes in one so-called ‘pool’.

That means it groups all the cash together to enable it to invest in more long-term assets, such as infrastructure.

Westminster wants to merge pension pools to create megafunds, whose significant scale it believes would bring benefits to workers who save their hard-earned cash into those pension funds.

But there are concerns from some that these changes will mean that pools, such as Brunel, will have to spend unnecessary money selling investments

In April, the government rejected a merger plan from Brunel, and its peer Access, which manages £45 billion, because it may want them to merge with another pool or pools to create an even larger entity.

Ms Gilmour has written to the government querying whether the approach of forcing Brunel into a larger pool is justified.

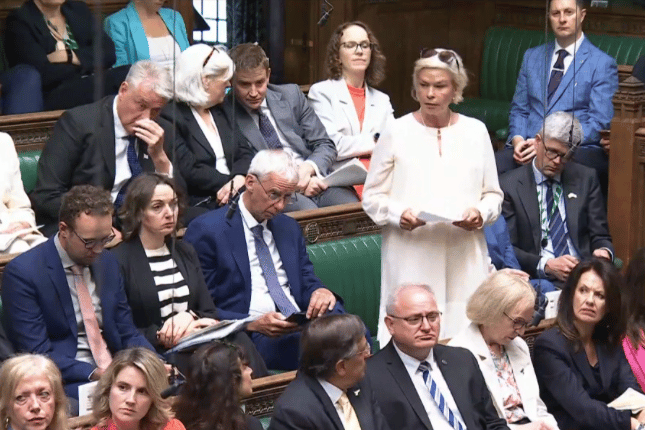

“Would the [government] agree with me that, by granting the Secretary of State binding powers to force through the disbandment of even our best‐performing investment pools, this Bill not only risks undermining the autonomy and track record of the Brunel Pension Partnership – which pools the assets of 10 local government pension scheme funds, including Devon and Somerset – but also could spell the incurrence of costly transition fees and put skilled local jobs at risk?,” Ms Gilmour said in her letter.

The proposed changes are included in the Pension Schemes Bill, which is currently going through Parliament and has passed its second reading stage in the House of Commons.

Councillor Steve Lodge (Liberal Democrat, Tiverton West), who chairs Devon County Council’s investment and pension fund committee, said predictions suggested the change could cost the county’s pension fund around £10 million.

“If you scale that across the 10 funds in Brunel, then it could be a lot of money,” he said..

“It is a loss to the pension fund, and other aspects are that if you have long-term investments that are more illiquid [such as stakes in infrastructure projects that are more difficult to sell than stocks and shares listed on a stockmarket] then the growth aspect of the fund is lost.”

Cllr Lodge said the pension scheme was responsible for ensuring public sector workers had adequate pensions when they retired, and that payments to retirees often stretched for longer periods due to rising life expectancies.

“We need to invest really wisely for the long-term, and so losing £10 million is not great,” he said.

“It is a real waste of money and a real shame.”

The Devon Pension Fund website states it has nearly 40,000 members who contribute to the scheme from more than 240 employers including unitary, district town and parish councils, education establishments and other organisations.

Nearly 41,000 pensioners receive payments from it every month.

Comments

This article has no comments yet. Be the first to leave a comment.